Introduction

Throughout previous posts, we have explored the basics of neodymium usage, the global flow of the material, the energy demand that comes with its production, and the subsequent impact that it has on people, the environment, and the world. While each of these areas is filled with its own complex factors, concerns, and interdependencies, certain common themes have emerged from the study of neodymium usage. By connecting these dots and considering the impacts that potential actions would have on a global scale, we are able to identify certain possible solutions to the issues associated with neodymium as a material, as well as the likely reactions that different bodies would have to those changes. This post will begin by recapping the most important concerns. Afterwards, we will discuss the changes that can be made through the individual lenses of materials, energy, and the environment, as well as the intersection of the three. Finally, for each aspect of neodymium’s material flow we will identify the possible response to and acceptance of these attempted solutions to gain better insight into the task before us.

Recap of Neodymium

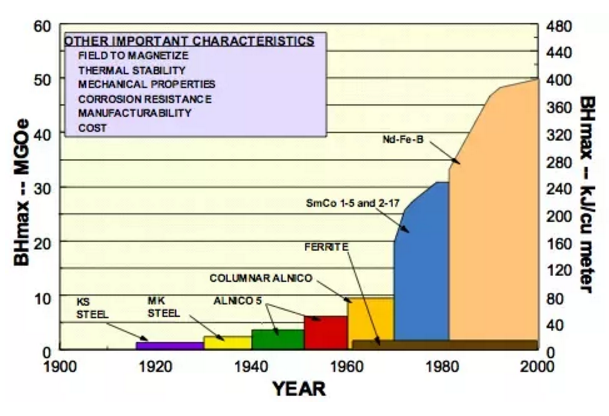

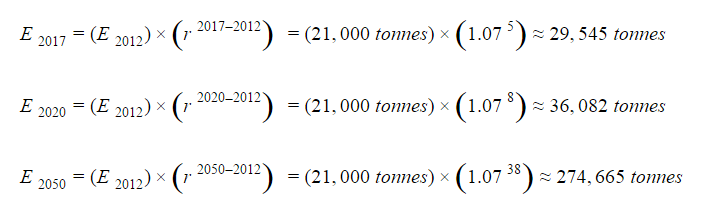

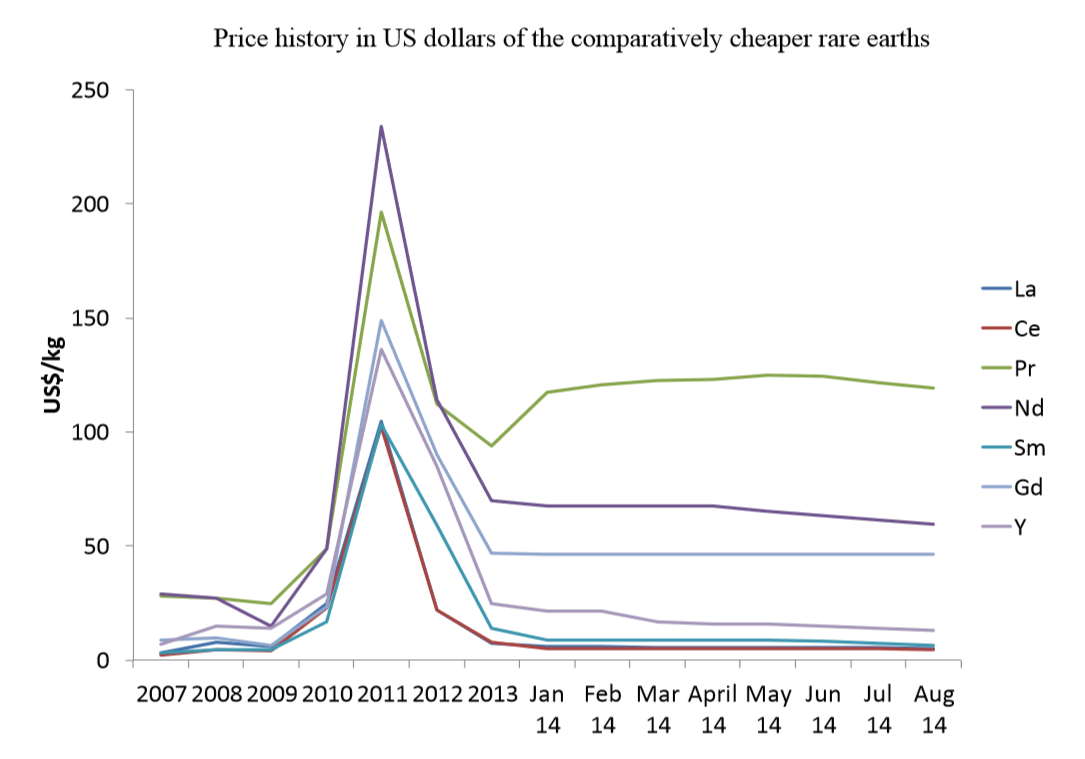

Neodymium is a rare earth element which, when combined with iron and boron, can create magnets with incredible properties. Since these magnets are very small, very powerful, and never lose their charge, they are used in a wide variety of applications. The three most important uses of Nd-Fe-B magnets are: speakers, computer memory, and generators. Since the number of technologies which use these magnets has risen steadily with the advent of laptops, wind turbines, and electric vehicles, the yearly demand of neodymium has risen exponentially, increasing at a rate of 7% each year, and is projected to continue to do so. This incredible rate brings with it several concerns. If neodymium mining and production fails to keep up with this rate of demand, the price will increase. Such a spike in cost could hinder the green energy fields which currently rely on the material. On the other hand, if mining and production do manage to keep up with demand, there could be other potential harms. Regulatory oversight of neodymium mining is already lacking in some areas, and increased fervor in mining the material would only make the environmental issues associated with improper disposal of waste water even worse. To top it all off, the manufacture of neodymium magnets, particularly the mining phase of the material, is incredibly energy-intensive. To find a solution to this complex challenge, one must consider the various material, energy, and environmental concerns associated with the material’s use over all stages and across several different acting bodies.

Solutions in Retrieval

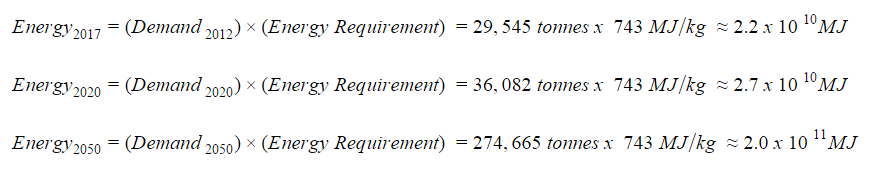

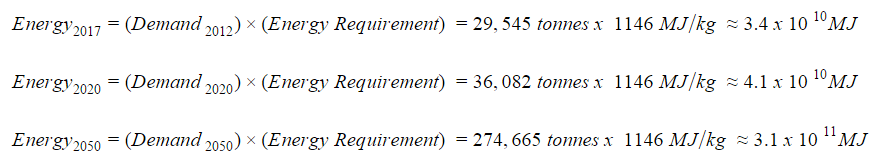

Before neodymium can be processed into Nd-Fe-B magnets, it must be extracted from monazite or bastnäsite ores. The first concern that comes to mind when considering this mining phase is the energy demand: 743 megajoules per kilogram of neodymium mined and extracted. Reducing this energy demand will only become more difficult. As current sources of the required ores are depleted, mining operations will have to look deeper and deeper into the earth’s crust, which of course, will require more energy-intensive operations. Mining Global claims that the secret lies in “continually monitoring, tweaking and reporting new updates [in order to] steadily improve system stability and unplanned downtime” and case studies have shown companies which successfully generate clean, on-site energy via renewable sources, or generate electricity to use via existing parts of the process, such as one which “generates electricity while transporting bauxite ore downhill from the mine to the rail station.” The next major concern with mining is the array of associated environmental issues. The water used in mining is contaminated with various minerals, metals, and chemicals. While this “wastewater” is ideally treated and disposed of in clean and safe ways, under-regulated countries often allow companies to dump this wastewater in nearby “tailing ponds”, where it can contaminate local water sources or cause health problems for the local population. The simple-to-conceive yet difficult-to-implement solution to this environmental concern is to implement better, stricter regulatory oversight to require proper wastewater treatment and prevent improper disposal. The final area of concern is the material considerations. It is in considering the material concerns of neodymium usage, such as the amount of the material flow and potential alternatives, that the realms of energy and environment collide. That is to say, if humanity can discover ways to reduce the usage of neodymium as a material, the related environmental and energy concerns will also naturally be addressed, by means of the reduced demand.

Response to Retrieval Solutions

Most of the solutions proposed to address concerns in the retrieval phase of neodymium require some sort of government involvement or oversight, and would thus vary in effectiveness from country to country. For example, the advances in energy saving mentioned were adopted primarily by European countries, where most citizens and companies are already fairly ecologically minded. Similarly, while strengthening regulations regarding wastewater in mining would be much easier in Europe, since European governments already devote quite a bit of effort to protecting the environment via such oversight, European mines are typically not the sites which require such directives. China, on the other hand, does require a great deal of improvement. Not only does 95% of neodymium extraction occur in China, but the country has also demonstrated issues with properly managing its wastewater and resulting toxic tailing ponds. Convincing the Chinese government to impose stricter regulations on the mining industry would likely require a great deal of time, effort, and global pressure. However, these companies could perhaps be convinced to implement energy-saving features if the initial cost was subsidized, since the end result would save on production costs.

Solutions in Industry

The bottom line regarding industrial use of neodymium is that too many companies, products, and services rely on the material. In terms of energy, one helpful route would be that of researching new, more efficient ways of using neodymium in the products that currently do. The magnetic induction provided by neodymium magnets and the electricity it produces are subject to enormous losses, so there is certainly room for optimizations which would lessen the adverse impact of neodymium in the energy sector. Once looking through the lens of environmental concerns, another strategy emerges. Educating the public on the potential environmental risks of overusing neodymium, such as raising the price or poisoning the countrysides of the areas that over-mine it, might provide the consumer-based pressure necessary to help retard the ever-increasing demand for the material in the industrial space. Finally, the primary solution in the material sense would be to find alternatives, such electrically-induced magnets, which do not require rare earth elements.

Response to Industry Solutions

Industry is likely the area in which reducing the material, energy, and environmental impact of neodymium would be easiest. Companies have already begun to research alternatives to neodymium-based magnets, either to save money or because they fear not having any options should neodymium prices rise or should neodymium supplies run out. Consumers, likewise, have recently become more aware of potential environmental issues surrounding rare earth element usage, thanks to the online articles which have exposed the effects of the toxic tailing ponds arising in China.

Solutions in Disposal

The majority of neodymium used in consumer products ends up being thrown away. In fact, it is estimated that only around 1% of neodymium ends up being recycled. In terms of energy, this disappointing statistic means that significant energy reductions which could be achieved through reusing recycled neodymium are not being realized. Researching efficient ways to extract neodymium from discarded products and recycle the material for reuse would no doubt lessen the energy demands of the material, especially since it is the mining and extraction phases which are so intensive. Again, education focused in the environmental risks of the increasing demand of neodymium might motivate consumers to actually recycle their electronics, something which people are usually hesitant to do.

Response to Disposal Solutions

In the United States, implementing recycling, disposal, or other post-use strategies for the material flow of neodymium would likely be difficult. Similar to extraction in China, this is an unfortunate reality, since the United States is the country where improvement in product recycling would have the greatest impact, due to the amount of per capita waste the country generates. While Americans could be convinced that recycling their headphones, speakers, earbuds, and laptops is the environmentally friendly thing to do, it is incredibly more difficult to actually convince an American consumer to take that course of action themselves. This opposition to taking effort to help the environment likely arises from the lack of recycling options in the United States, which in turn makes recycling their electronics very inconvenient. As such, response to attempts to increase recycling rates for neodymium products would likely be disappointing unless the American government takes action to encourage and subsidize the development of proper recycling facilities. While other countries would obviously also benefit from such a solution, implementing it successfully in the United States would have a great impact.

Conclusion

While rare earth elements like neodymium are very useful, current reliance on neodymium magnets could prove to be hazardous or detrimental if the use, impact, and disposal of the material is not soon reduced. Through a combination of spreading awareness, encouraging research into alternatives, incentivization of more efficient usage, and regulation of the current extraction and production, governments, countries, companies, and consumers could work together to help prevent the risks associated with over-dependence on neodymium and other rare earth elements.

Works Cited

This post is a summary, recap, and final conclusion post made using the research from each of the four preceding posts. As such, the information used in this post is largely derived from the sources cited in those previous ones. For links to the materials that were used or referenced, please see the Works Cited sections of those posts:

Introduction to Neodymium Usage

The Material Flow of Neodymium

The Energy Demand of Neodymium

Additional referenced materials include:

http://www.energydigital.com/renewable-energy/how-reduce-energy-consumption-mining